Insurers and Reinsurance Brokers are experts in understanding risk.

But their own risks can lurk in 'dark' document data.

In the property and casualty insurance world, it's vital to understand portfolio risk for named insureds across property, general liability, auto, and other lines. A lot of that information resides in the form of correspondence documents between carriers, brokers, and the insureds.

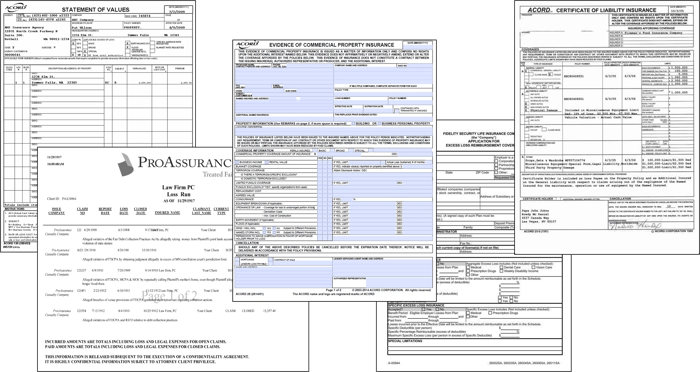

Statement of Values, Loss Runs, Evidence of Commercial Property Insurance (Acord 28), and Certificate of Liability Insurance (Acord 25) documents – they tell an important story that is often very difficult to decode. The data requires manual, digital effort to be revealed, and can be overwhelming.

All too often, that valuable correspondence ends up as a series of attachments inside major Agency Management Systems like Applied Epic and Vertafore BenefitPoint. These PDF, Excel and Word documents differ wildly in their formatting, layout, and naming conventions.

This makes discovery, extraction, and transformation of these documents into data feeds a challenging proposition. In essence, these documents go 'dark' once they enter an Account folder.

Exposing the risk in a structured, accurate, automated way is the first step.

What if there was a way to discover and extract this critical information from SOVs, Acord 25, Acord 28, Flood Declarations and Loss Runs in an automated and replicable manner?

What if you could compile Total Insured Value (TIV), Incurred Loss, Roof Covering, Fire Protections, Limits, Deductibles and more; quarter-on-quarter, year-over-year to generate customized risk profiles and maps specific to the portfolio you have exposure to?

With Docugami, that’s possible today. Docugami deconstructs these disparate Loss Runs, Statement of Values, Acord 28 and Acord 25 (and other) documents through ‘document engineering’, leveraging state-of-the-art artificial intelligence. In minutes, Docugami prepares a precise output of a given PDF or Word or Converted Excel document.

-

These documents come with wild variations in formats.

- Unlocking the data in a usable form can be expensive, time-consuming, error prone.

Next? Make the data available for analysis and insight.

Docugami's output is readily consumable by downstream systems of your choosing: trusty and powerful Excel, your Agency Management System (such as BenefitPoint or Applied Epic), or databases (SQL Server, Snowflake, or Oracle) for deeper analysis.

We generate outputs in Hierarchical XML or Tabular (CSV/Excel) formats. Better yet -- plug the data into a Catastrophe Model (aka CAT model) of your choosing, whether Casualty Catastrophe (CCAT) or Property Catastrophe (PCAT).

The data Docugami unlocks enables higher resolution for your model's Event, Hazard, Vulnerability and Financial modules. It also serves to provide data feeds for more sophisticated CCAT models (e.g., Praedicat and AIR) that capture the latent tail risk of such events. Glyphosate and Talc being the most recent.

Reinsurance Broking firm Guy Carpenter cites CCATs as “the most daunting threat that casualty reinsurers face today,” according to the NAIC's Center for Insurance Policy and Research. With Docugami, you light up the dark documents inside your Agency Management System, resulting in richer data feeds, deeper insights, and greater ability to manage your risk.

Learn how Docugami’s AI solutions can reduce stress while saving time and money for your organization. Schedule a demo today.