Save time, effort & cost creating Certificates of Insurance

Commercial brokerages spend a LOT of time doing what seems simple, but is actually complex enough that it has rarely been automated: turning the information locked in commercial insurance policies into Certificates of Insurance (COIs), or proof of insurance for their clients.

Companies often need to provide evidence of specific commercial insurance coverage, when they are negotiating or conducting business transactions. Whether providing IT services, selling software, renting commercial space, leasing out an office, hiring a contractor, managing a construction project, or nearly anything else, they need a COI prepared.

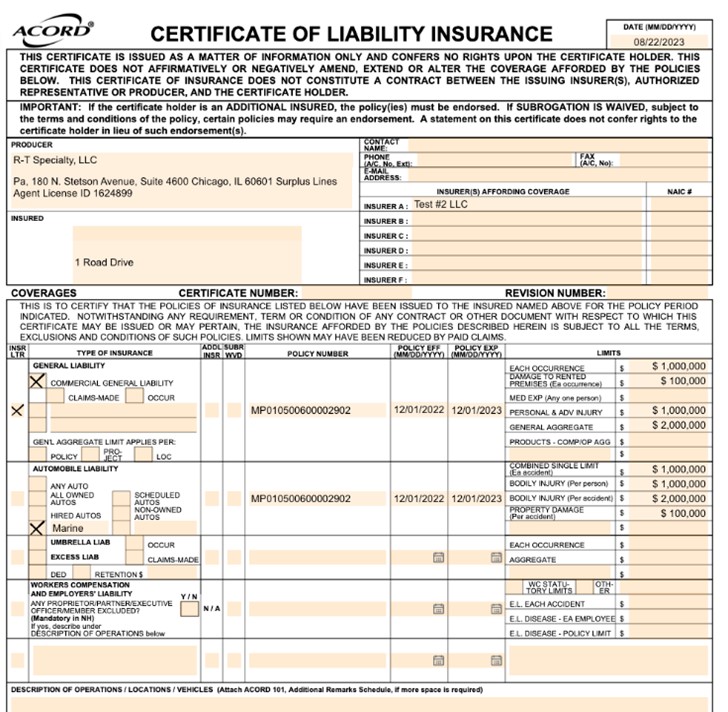

The COI is a concise document that provides policy details on General Liability insurance coverage, Worker’s Comp, Excess Liability, and other coverage and exclusions, verifying that a company has the business insurance they claim to have. It summarizes essential information like the types and limits of coverage, the issuing insurance company, the policy numbers, insurance limits, the named insured, and the policy’s effective and expiration dates. These details exist in a long, complicated policy document. Essential information from a 100+ page document must be condensed into one page.

Your staff has quite a tedious and time-consuming job to do, to manually crawl through these policy documents and come up with just the right data for the COI.

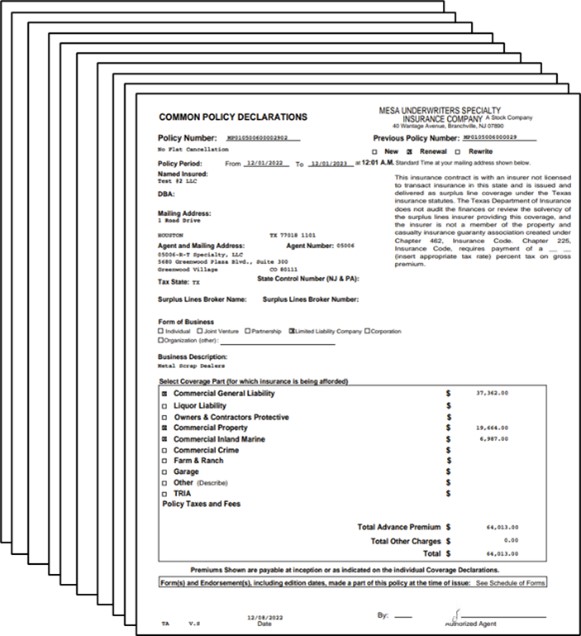

Complex policy documents are the source of the coverage information.

This is a sample view of one page of an anonymized, 144-page commercial insurance policy. The complexity of the document should be familiar to most people interested in this blog.

Clearly, a summary -- with accurate -- data is needed!

Certificates of insurance are typically issued by an agent or broker for the named insured and lay out the coverages (and importantly, any exclusions) written for the insured. They represent a specialized summary of policy information, and they change, based on the type of policy they are summarizing. Here is a sample.

The challenge here is that the broker needs to go through the tedious process of reading through that 100+ page policy to cherry-pick the important coverages, limits, deductibles, exclusions, and other information to fill out the corresponding ACORD certificate. If the coverage needs to change due to changing circumstances in the future, typically a new COI will be required.

Lost staff time, high cost, potential for errors, and staff tedium: not good.

More often than not, the burden falls on the broker, or administrative staff to plow through the information and create COIs from scratch. Even though policies may contain similar information for a given line of coverage, they also vary highly in the options and the way information is presented in the document, depending on the carrier that produced it. So it is not trivial work to wade through the variances, to find the correct information. This opens the door for human error to creep into the equation, as well as creating an added cost to train employees on where to look, and what language to expect for a given carrier’s documents.

But how to automate this work?

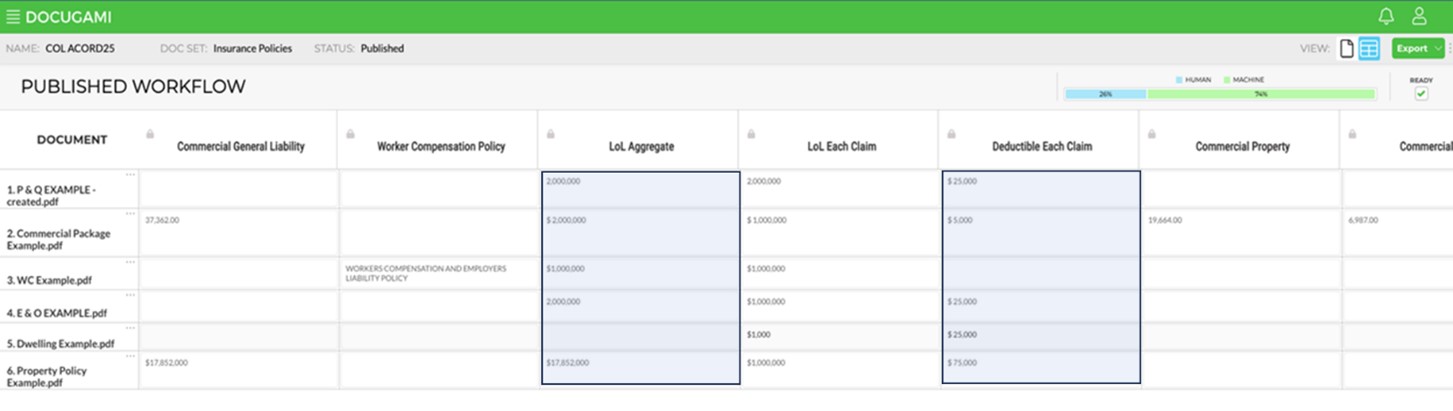

Artificial Intelligence can now be deployed to make this happen. To begin the process, just upload the relevant policies to Docugami, and our secure, confidential processing of all pages gets started. Docugami's specific AI approach decodes these long complex documents into chunks of related data, automatically. Then the AI can be trained with a few sample documents, to understand precisely what the broker needs to extract. To do this, a business user just points to the essential information needed for COIs from several policies, and Docugami does the rest.

The necessary information is then automatically extracted from every policy and appears in a newly structured tabular format. New policies coming in can be automatically uploaded and processed. In this example, the policy documents are listed in the rows on the left of the table, and the items to be extracted are shown across the columns. The data elements extracted from each document show up in the cells.

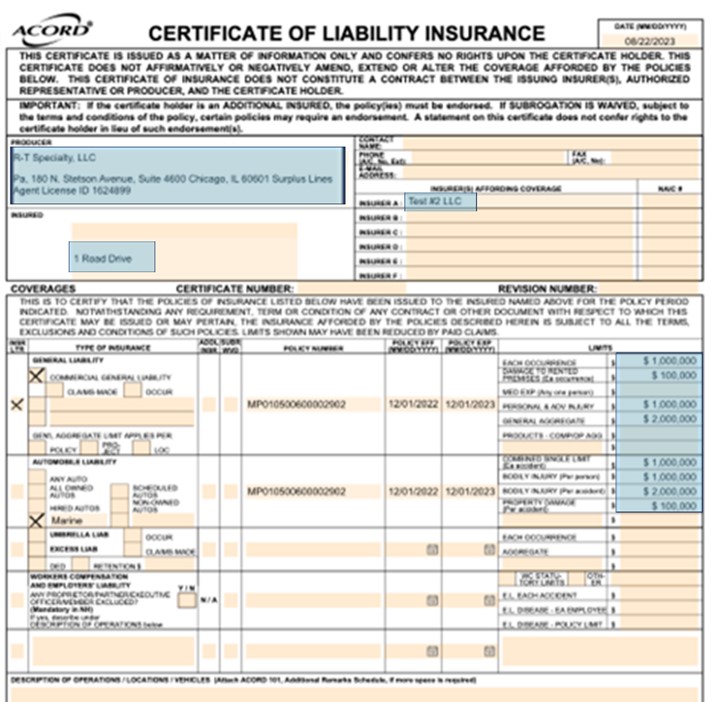

The information can then be set up to be used by common 3rd party tools, like Zapier and PDF Filler, to automatically apply rules to map the extracted policy data into the right places in the COI form, to create new, complete, accurate COIs from any policy. Any time a COI is needed, just upload the policy to trigger the workflow. The relevant data is injected into the Acord form.

Information flows, From Policy To COI, Over and Over Again, Automatically!

To learn more, and see other powerful Commercial Insurance AI use cases, here are some additional resources, or you can set up a personal demonstration here..