Software Technologies Have Fallen Short

Classic “intelligent document processing” platforms and purpose-built industry solutions struggle with variability, require continuous reconfiguration, lots of freshly labeled data, and extensive human-in-the-loop review to produce usable structured data streams. This is particularly taxing for organizations looking to have Loss Runs processed the moment they are received.

Until Now

With Docugami, the game changes. Simply upload your documents via our Cloud Storage Connectors (SharePoint, OneDrive, Box or Dropbox) or our REST API. In minutes, we will have these documents processed through our Generative AI pipeline, making them ready for use.

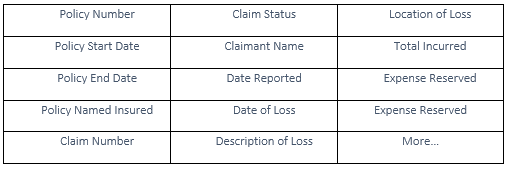

Use our web app to design your project, identifying all the pieces of information you want Docugami to collect on your behalf.

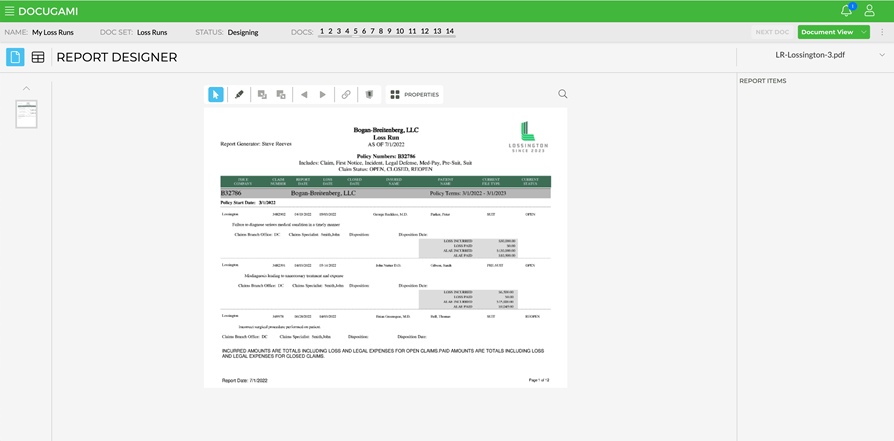

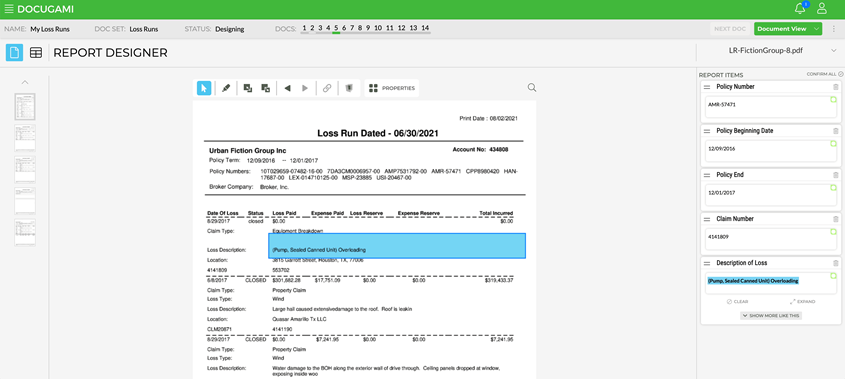

Here is an example of a user telling Docugami in 23 seconds that they want the Policy Number, Policy Beginning, Policy End, Claim Number and Description of Loss:

Easy enough, but it is just one fictional Carrier’s template. What about the other Loss Runs from other Carriers in the set? Will we have to configure them too? The answer is no!

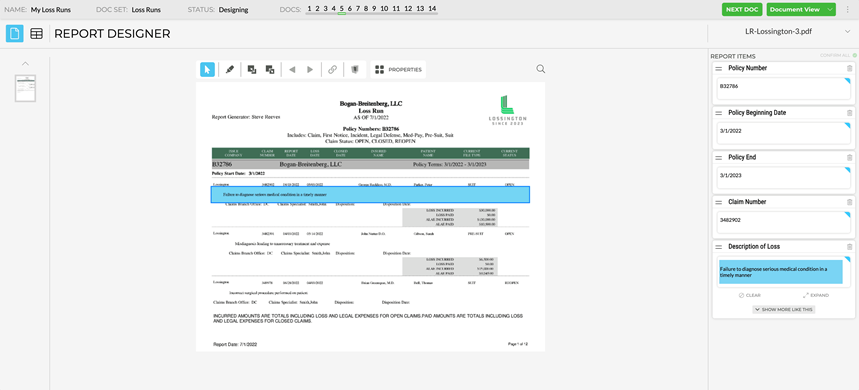

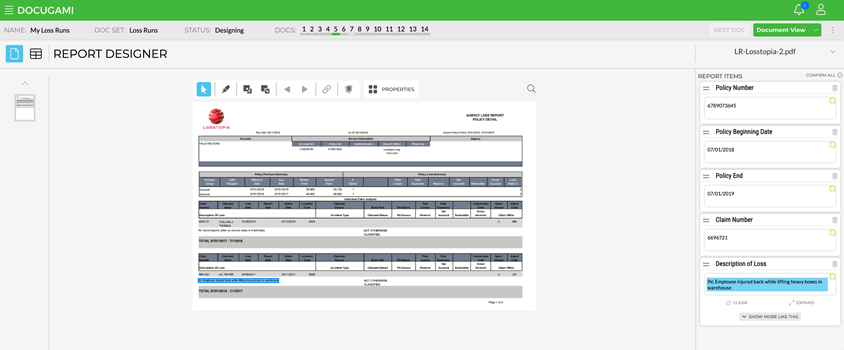

Notice how with a radically different Loss Run format, Docugami is able to semantically find the appropriate chunks of information.

The pattern continues for the next Loss Run as well:

And for every Loss Run in this set, and every future Loss Run that is sent to Docugami for processing.

The Recap:

- Docugami understands the semantics and structure of document information – thus coping with the enormous variability of Loss Runs.

- Users can unlock the vital data from Loss Run documents and create a structured data stream your systems can use, in a matter of seconds.

We encourage you to explore Docugami Generative AI on your own and consider how we can build value with you!